Four Strategic Mistakes.

What is strategy?

Strategy is Future Competitive Advantage.

What will the future look like? What will people need and expect? How will demographics, technology and other global shifts create new competitors or recharge current competitors and how will categories blur, blend and maybe even disappear?

Amidst these new expectations and changing competitive dynamics what advantage will your company offer? A differentiated or better product? A competitive moat of network effects, scale or some other dynamic? A better experience? Speed and value?

When companies get strategies wrong they tend to make on or more of the following four mistakes:

Mistake 1: Strategies that limit ones competitive set or define categories by the companies one currently competes with.

Many companies do not get strategy right primarily because they do not understand the exponential impact of technology and make the cardinal mistake of defining their category and competitive set looking backward versus forward.

One example among many is the auto category which defined the key drivers of their category in ways that did not see a Tesla or an Uber for years after they began to scale. How could software be as, if not more, important than hardware? How could electric be better than internal combustion engines? Do most people need the expenses of owning cars or do they just need on demand mobility?

Now just when electric appears to be the future companies like Toyota are striking back with a “both” versus “either gas or electric” strategy with hybrids that are starting to outsell pure electric options.

Look where there is transformation in a category and the instigator is usually from outside the category or a sudden renaissance from an incumbent that everybody believes has been left behind because they start to think differently like Toyota did or as Domino’s did in re-imagining pizza delivery.

This insular or present/ backward focussed bias happens for many reasons including the innovators dilemma of companies not wanting to disrupt themselves, leadership teams hoping that they will retire before the next tsunami hits and incentive plans built to maximize today despite the entire companies future being tomorrow.

A company’s greatest opportunities and threats usually come from outside its category.

If a strategy is based only on existing competitors and todays category definitions, it may be dead on arrival.

Mistake 2: Strategies built by extrapolating todays realities into tomorrow.

Many strategies were developed or continue to be developed assuming what has been true for over a decade will remain true.

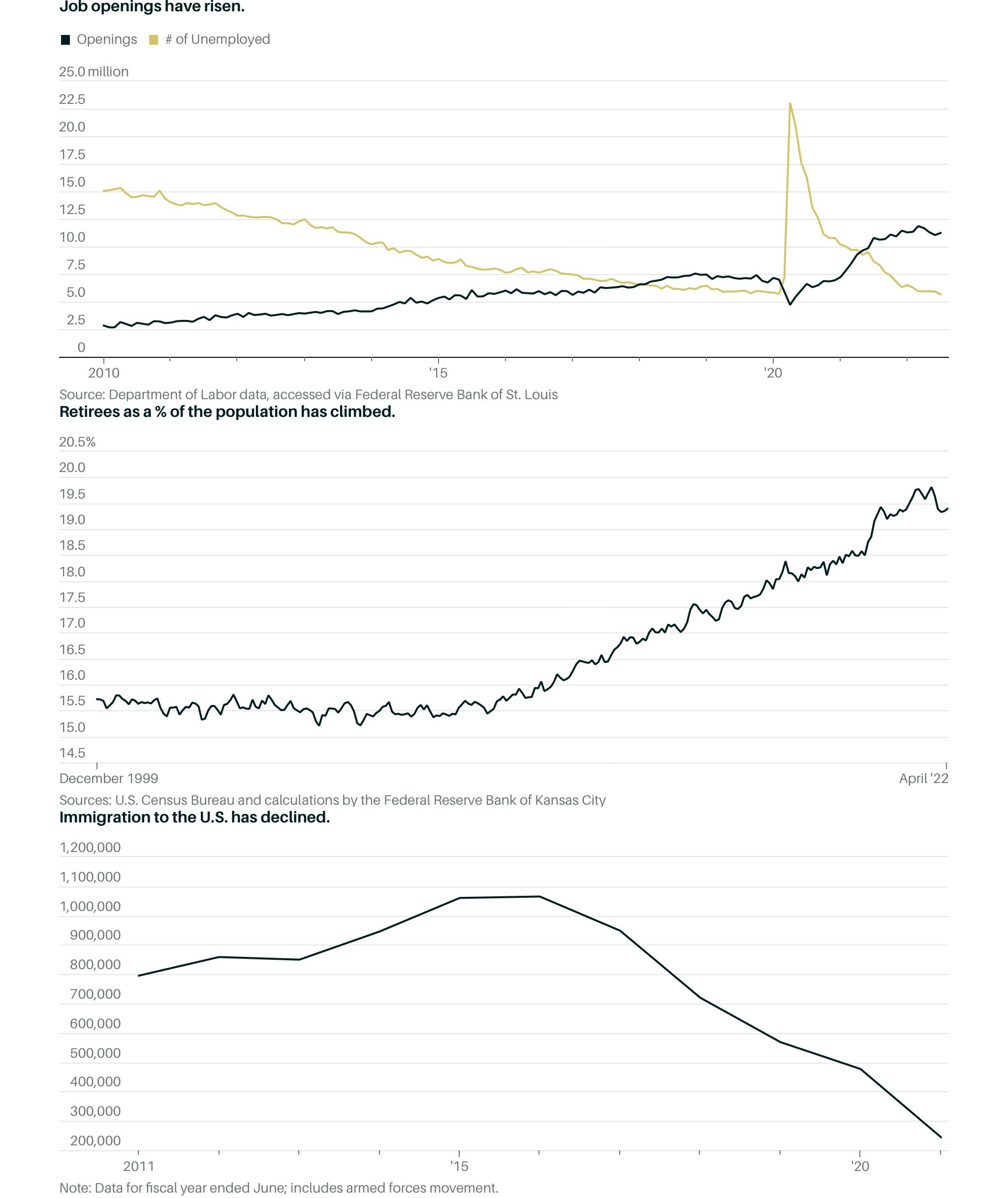

a) Expanding and aging populations: When calculating “Total addressable market” or “rate of growth” most companies factored in growing populations.

Now the exact reverse is beginning to happen. Populations have started to decline in most advanced economies at a frightening rate.

It takes 2.1 children per mother to keep the population the same. The average across most developed countries is 1.7 and it is 1.1 in China. For the first time in the US the number has fallen below 2.1 and the population has declined this past year.

With low or no immigration, the US population according to the US census has peaked and only with high immigration will the country pass the 400 million mark. With no immigration the population will fall by one third in the next 50 years from 335 million to 226 million.

And populations are not just declining but aging fast. 10,000 people turn 65 every day in the US. By 2030 one of out of every five Americans or 20% of the US will be over 65 almost double the proportion from 2010.

With more people growing older and over half the wealth in most countries held by those over 60 every company should not just fixate on Gen Alpha and Gen Z but the other end of the age spectrum !

b) Scale is a competitive advantage: One of the long-standing tenets of business are the advantages of scale.

Scale has provided companies with many benefits from higher margins due to lower costs, to insulation from competition due to moats of marketing spending and widespread distribution.

Over the past decade however the benefits of scale have diminished and in some cases are proving to be a disadvantage:

Scale of Distribution: With direct-to-consumer marketing enabled by the Internet and platforms like Shopify, widespread retail distribution is no longer as effective an advantage. Clearly distribution matters but there are ways to route around the big stores by going direct and creating demand that forces buyers to stock your product.

Scale of Communication: New media behaviors by people particularly search and social are leading to communication channels where spending power is no longer a competitive edge as it was in television or print where marketers cornered key inventory at advantageous prices. Platforms like Facebook enable millions of small businesses with personalization and targeting capabilities to discover customers and be discovered. As content supported by advertising declines to less than a third from nearly two thirds the scale of spending while still being important is losing its potency.

Scale of Manufacturing: The “Everything as a service” platforms from Amazon Web Services to Foxconn allow smaller companies to gain the edges of scaled manufacturing, distribution, and technology without any of the legacy disadvantages of size.

Scale of People: From IBM to GE to Unilever to Walmart there are hundreds of thousands of employees and therefore ability to recruit and grow a range of talent and offer career advancement. Scale of people continue to be important to execute complex and large tasks but there are also new ways to re-aggregate talent. And a generation of talent wants to work in smaller and more entrepreneurial environments. In the post Covid world as we move to unbundled workplaces there will be far more ways to build teams both globally and in real time than ever before.

Legacy scale still matters in most industries and is critical in quite a few like semi-conductors. In fabricating advanced chips, a new fabrication plant can cost over 4 billion dollars and there is no way around scale. Today TSMC (Taiwan Semiconductor Manufacturing Company) dominates due to its scale.

However, while we can never underestimate legacy scale, there are new forms of scale that every smart company recognizes and is expanding into such as the scale of networks, scale of data, scale of influence and scale of talent and ideas.

c) Capital and talent are in abundant supply: As the world has moved away from a Zero Interest Rate Policy regime the past decade of easy access to capital is shredding so many strategies that were built on low to no cost of capital.

The bigger long term shift is the shift of power and options to talent and labor away from capital and management in many developed markets.

The first factor is simply demand and supply dynamics are changing as populations in these countries decline and age and immigration is limited as the chart below shows.

Then one has changing mindsets of talent whether it be Gen-Z questioning the current workplace or post Covid-19 mindsets where all our minds are like champagne corks in that they have swelled and no longer fit back into the world that management desperately hopes to will back.

And then there is a huge surge in talent looking to maximize their optionality with 66 percent of Gen-Z who have a full time job also having a side hustle or gig for additional compensation and building an off ramp into a new career. In the US 76 percent of Gen-Z want to work for themselves with the number in East Asia now higher than 80%?

This combination of low unemployment, new mindsets among white collar workers and a significant increase in Union power has stunned boards to such an extent that after AI, companies most frequently call out Unions and Talent as key areas of impact in earning calls.

The future vectors of change will not be built around the forces of the past

Mistake 3: Strategies focused on technology trends.

Every board loves a deck with Excel spreadsheets and Powerpoints panting excitedly on every page about the buzzword bingo of the moment.

It used to be personalization, platforms, data lakes and disruption.

Then it was Web3, Direct to Consumer, Metaverse, Blockchain.

Now it is AI here, AI there and AI everywhere!

While AI is expected to be even more transformational than the Web and the iPhone combined and will change the contours of business and life, it is highly unlikely AI itself will be a differentiator to a majority of companies.

In fact it is likely to be a commodity like data.

Both are like electricity.

No company will be able to compete without significant data and AI investments but it highly unlikely that it will be the data and the AI that will be the differentiator.

The future of AI in a company will be about how it is used not to replace but to turbocharge HI ( Human Inspiration). And CFO’s who believe AI will replace people and generate savings should also keep in mind that world class talent with AI and a clean sheet of paper might also replace many existing companies! (Thus leaving the cost cutting CFO without a job!)

In fact the real good CFO’s are investing, learning and starting to leverage AI to turbocharge growth versus only guillotining costs! (Without a doubt anything that a machine can do better will be done by a machine and so there will be savings and elimination of many tasks).

Technology including AI should be an input to strategy rather than writing strategies around technology !

Mistake 4 : Strategies that do not incorporate talent dynamics.

Unless talent in an organization is aligned and trained with the new strategy and therefore their behaviors are transformed, the company will not transform and the strategy will not be any real than the posters, t-shirt, and coffee cups that they are embossed on.

After the strategy document, the M&A plan, and the re-organization (all of which are important) nothing gets done unless the messy issue of people are dealt with and therefore talent dynamics should be a key part of strategy planning.

Specifically:

Why is the strategy good for the employees ? Why is it good for their personal future competitive advantage? ( Telling talent things like it is good for the company or if they do not change they will lose their jobs has zero motivational power or impact).

How will incentive plans be changed to align future behaviors with the new strategy? (To understand behavior of talent and management follow incentive plans not strategy)

What is the training and growth development plan? (Any strategy which does not invest in training and upgrading people to align with the new direction or strategy is purely delusion)

And this will remain true in the AI age where while every job will change and many white collar jobs (unlike in previous technology shifts where blue collar jobs were impacted) may be eradicated talent will still be key.

History has shown that very advance in technology places a premium on superior ability.

Today there are marvelous breakthroughs in AI technology from Open AI, Anthropic, Adobe, Google, Meta among the big firms and companies like Runway ML, Pika Art, Eleven Labs, and hundreds of others.

They are all awe inspiring and jaw dropping technologies that are advancing at rapid speed.

But remember the typewriter did not write “A Farewell to Arms” but Hemingway did.

If I had a word processor and ChatGPT and Hemingway has a pen he would write better.

If Hemingway also had ChatGPT the distance between us would be even wider.

Hemingway with a Substack would have scaled amazingly better than most.

It is not the technology; it is the talent.

Talent has scaled globally using technology like a lever.

So, we should worry less about how AI will replace talent but how we will leverage AI to scale ourselves, our teams and companies.

Growing, leading, attracting, retaining, and investing in talent is going to be a key strategic advantage.

Every human and individual and employee with the right support and placement can be highly productive and valuable.

Every strategy deck should have a significant section on how to turbocharge and build the strategy leveraging talent and not just focus on competitive dynamics, financial metrics and total addressable market and other data.

Companies grow and transform when talent grows and transforms.