Re-thinking Strategy.

What is strategy?

Strategy is Future Competitive Advantage.

What will the future look like? What will people need and expect? How will demographics, technology and other global shifts create new competitors or recharge current competitors and how will categories blur, blend and maybe even disappear?

Amidst these new expectations and changing competitive dynamics what advantage will your company offer? A differentiated or better product? A competitive moat of network effects, scale or some other dynamic? A better experience? Speed and value?

Very few companies even today get strategy right primarily because they do not understand the exponential impact of technology but also because they make the cardinal mistake of defining their category and competitive set looking backward versus forward.

One example among many is the auto category which defined the key drivers of their category in ways that did not see a Tesla or an Uber for years after they began to scale. How could software be as, if not more, important than hardware? How could electric be better than internal combustion engines? Do most people need the expenses of owning cars or do they just need on demand mobility?

Why the strategy of every organization needs to be re-thought.

If a key to strategy is the future what happens when the contours of the future shift dramatically?

In the past five years things have become far more complicated.

More moving parts, buzzing around at faster speeds in ways that are more interconnected to each other.

Many of the assumptions that underpinned strategy have not only shifted but, in some ways, the exact opposite of what firms believed is coming true.

Here are just a few “beliefs” that now need to be queried:

a) Expanding populations: When calculating “Total addressable market” or “rate of growth” most companies factored in growing populations.

Now the exact reverse is beginning to happen. Populations have started to decline in most advanced economies at a frightening rate.

b) Scale is a competitive advantage: While scale still matters it matters far less than ever before (except for a few businesses where it matters even more) and the very nature of what is scale is changing with many old forms of scale being competitive disadvantages!

c) Capital and talent are in abundant supply: Capital continues to remain in abundant supply but has become a bit more selective, but talent is in such short supply that the greatest ROI for businesses may come from unleashing the untapped capacity of their talent. Return on Human Capital will be a key measure of return joining Return on Capital and other metrics.

Population declines in advanced markets.

It takes 2.1 children per woman to keep the population flat.

That number in most advanced countries is less than 1.7 and declining.

The latest UN projections suggest that the world’s population could grow from 8 billion people to a peak of 10.4 billion before the end of this century. But if we exclude population growth in Africa the population of the world has peaked and, in a few countries, we are starting the great shrinkage.

The Shanghai Academy of Social Sciences team predicts an annual average decline of 1.1% beginning in 2021 pushing China’s population down to 587 million in 2100, less than half of what it is today.

Every business should interrogate their strategy to ask two questions a) how will our plans be impacted in our key markets with declining populations and b) what is our plan for the continent of Africa which will contain more 40 percent of the global population in 2100?

Scale may no longer be the competitive advantage we think.

One of the long-standing tenets of business are the advantages of scale.

Scale has provided companies with many benefits from higher margins due to lower costs, to insulation from competition due to moats of marketing spending and widespread distribution.

Over the past decade however the benefits of scale have diminished and in some cases are proving to be a disadvantage:

Scale of Distribution: With direct-to-consumer marketing enabled by the Internet and platforms like Shopify, widespread retail distribution is no longer as effective an advantage. Clearly distribution matters but there are ways to route around the big stores by going direct and creating demand that forces buyers to stock your product.

Scale of Communication: New media behaviors by people particularly search and social are leading to communication channels where spending power is no longer a competitive edge as it was in television or print where marketers cornered key inventory at advantageous prices. Platforms like Facebook enable millions of small businesses with personalization and targeting capabilities to discover customers and be discovered. As content supported by advertising declines to less than a third from nearly two thirds (scale of spending while still being important is losing its potency.

Scale of Manufacturing: The “Everything as a service” platforms from Amazon Web Services to Foxconn allow smaller companies to gain the edges of scaled manufacturing, distribution, and technology without any of the legacy disadvantages of size.

Scale of People: From IBM to GE to Unilever to Walmart there are hundreds of thousands of employees and therefore ability to recruit and grow a range of talent and offer career advancement. Scale of people continue to be important to execute complex and large tasks but there are also new ways to re-aggregate talent. And a generation of talent wants to work in smaller and more entrepreneurial environments. In the post Covid world as we move to unbundled workplaces there will be far more ways to build teams both globally and in real time than ever before.

Legacy scale still matters in most industries and is critical in quite a few like semi-conductors. In fabricating advanced chips, a new fabrication plant can cost over 4 billion dollars and there is no way around scale. Today TSMC (Taiwan Semiconductor Manufacturing Company) dominates due to its scale.

However, while we can never underestimate legacy scale, there are new forms of scale that every smart company recognizes and is expanding into.

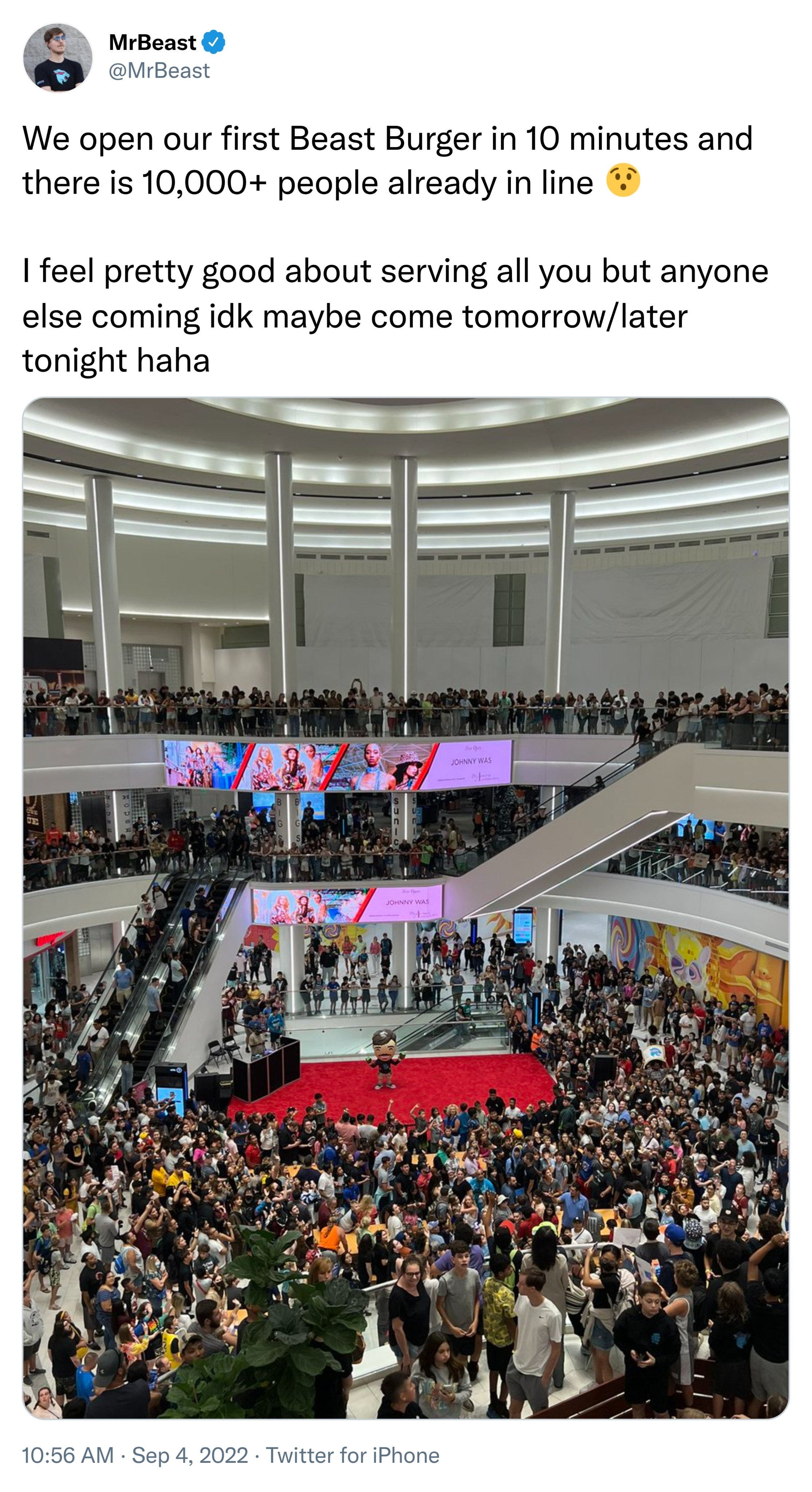

Here is the gentleman with the greatest following on You-Tube who launched the first of a chain of pop-up burger restaurants last Sunday.

The New Scale.

Scale of Data: Increasingly companies are realizing that collecting, refining, and leveraging data is what is driving the modern fast growing and highly valued companies from Amazon to Google to Uber. Data enables a new form of scale which is that of mass personalization.

Scale of Networks: On the Internet network effects play a dominant role in creating winners. Dominant platforms such as TikTok, Facebook, Netflix, and Tencent (WeChat) enjoy flywheel effects of more users attracting more users and therefore marketers and businesses.

Scale of Influence: Today individuals have tens of millions of Instagram followers or leverage Twitter and TikTok to reach hundreds of millions of people with single posts and tweets. If you look at scaled entities on social media, they are individuals. People are seen as authentic and certain folks like Elon Musk can move markets.

Scale of Talent and Ideas: One of the lessons of history is that every advance in technology places a premium on superior talent. Technology is a lever and when married with great talent a company enjoy major scale effects.

A vivid example of how the new scale works is Kylie Cosmetics. Kylie cosmetics was launched by Kylie Jenner to sell lipstick. In less than two years Kylie Cosmetics sold 900 million dollars of product making the 21-year-old the fast billionaire ever. Kylie cosmetics had less than 50 full time employees, outsourced manufacturing to Seed Beauty a contract manufacture and all e-commerce and fulfillment to Shopify. The single media channel besides PR that Kylie Cosmetics used was Kylie Jenner’s Instagram account with 120 million followers+ (more than the ratings of the top 10 prime time television shows combined)

And even new scale can be disrupted as TikTok’s focus on video and entertainment and a new algorithm allowed them to overtake Meta indicating that Meta’s multi-billion-person social graph which married great data and network effects of new scale could not stop a juggernaut from rising in less than five years!

One of the areas every leader should study is where the Internet is heading. Web 3, Metaverses, Tokens/Wallets and DAO’s have many challenges and noise around them but they are truly revolutionary and will accelerate power to talent and individuals in exponential ways.

Ideas and talent are the true moats everything else can be bought pennies on the dollar.

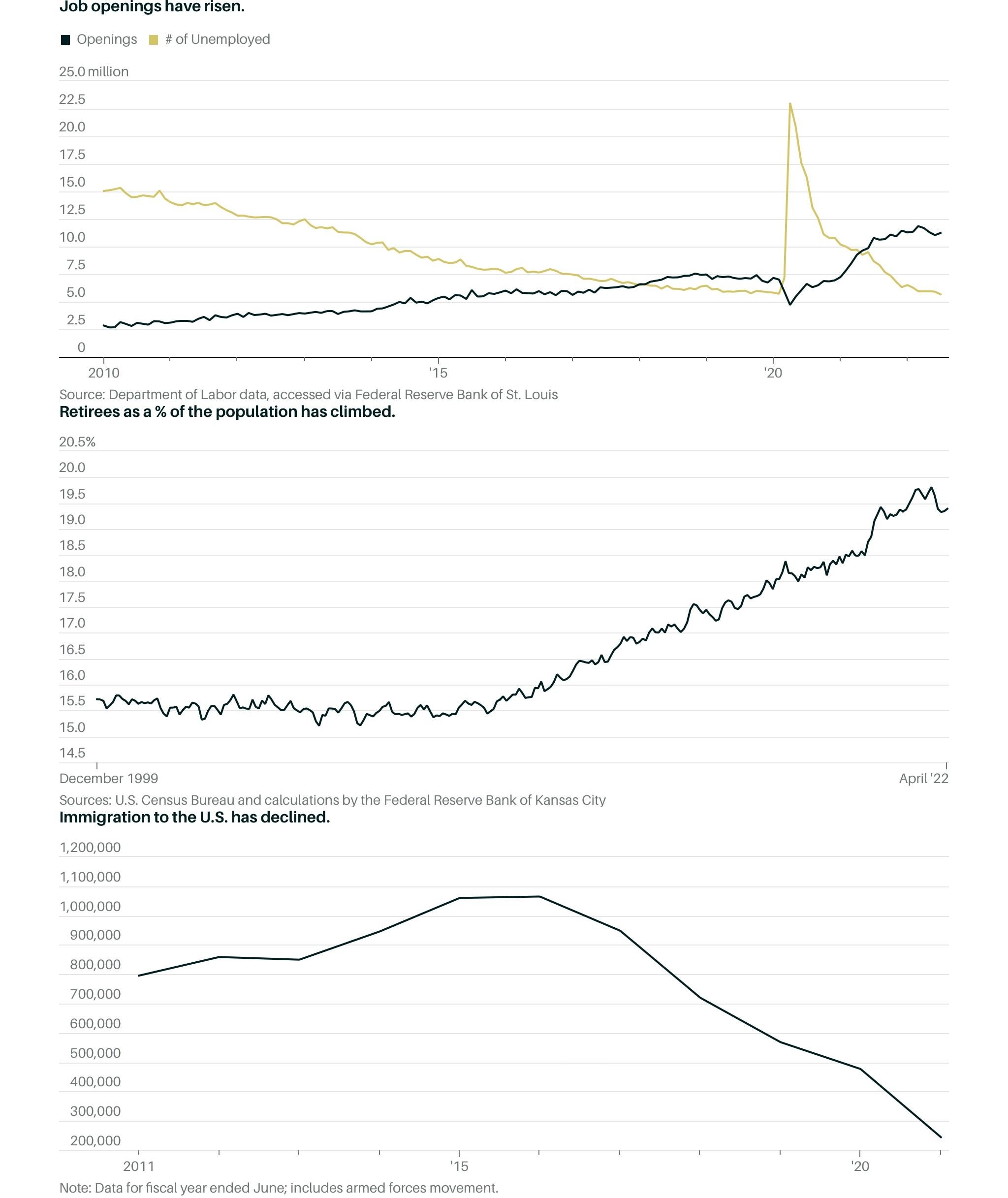

The scarcity of talent.

Talent is all. Talent is in short supply. Talent needs to be paid attention to if any strategy is going to work in the future.

The charts above which are for the United States indicate the scale of the challenge anyone hiring talent in the US will face as populations age, immigration stalls while the number of jobs grow.

Add to that the reality that over a quarter of people have moved hundreds of miles from their original office, many people have side-gigs and have begun portfolio careers and that one can work for a spectrum of global companies from anywhere where one has a good Internet connection!

Growing, leading, attracting, retaining, and investing in talent is going to be a key strategic advantage.

Every human and individual and employee with the right support and placement can be highly productive and valuable.

Every strategy deck should have a significant section on unleashing talent and not of competitive dynamics, financial metrics and total addressable market and other data.

Companies grow when talent grows.

Next time you here about a company changing their CEO no matter what they say what is really happening is one or more of the following:

a) They have over invested in China or have overestimated growth in and therefore the total addressable market in the US, Europe, Korea, and Japan.

b) They have over built particularly too many stores or too many theaters or just too many thinking they could crowd out competitors. Now they have a sea of sameness that looks dated and is a legacy cost versus an asset.

c) Their leadership has a talent problem or there has been a break down in the social contract between the people who do the work and are on the frontlines and management.