Squeezing Time.

The Persistence of Memory by Salvador Dali.

This post was inspired by a conversation with and informed by content provided by Chris Outram, EVP, Head of Blockchain for Publicis Groupe Media ,who provides ongoing coaching and homework to keep me updated on Web 3 which Publicis defines as a constellation of AI, Blockchain, and XR (AR/VR/Spatial Compute).

1. Squeezing more into time.

Is time squeezing us or are we squeezing time?

Everything seems and feels faster and paying attention or slowing down makes us a) wonder whether we will fall behind, b) fear we are missing out (FOMO), or c) we find things too slow, non-stimulative and boring.

We want it faster. Sooner. Quicker. More. Multi!

Across many fields we find ourselves addicted to an increased metronome of living:

The Rise of Dopamine Culture by Ted Gioia

2. Squeezing Screens into the same Time.

For the past few weeks I have been using Apple’s Vision Pro which in addition to being the best video and image content consumption device ever invented ( yes it is very expensive too) which also has pulled off a break-through in human and computer interface.

It has also enabled a multi-screen sensory experience where one can be writing a presentation, scrolling a social feed, watching a stock ticker, enjoying a movie and much more without the need for multiple screens or a lot of space.

It takes multi-tasking to another level and it can be done anywhere!

As the technology improves, the weight is diminished and the price reduced one can imagine that in less than three years this may be a large part of our future.

3. Squeezed by being born at the wrong time.

In the first chapter of my forthcoming book “Rethinking Work” I reveal many generational shifts and demographic trends that will alter the future of work. It was in this context that I learned about “Financial Nihilism” as Gen-Z and Millennials have a starkly different outlook to capitalism, companies and the way world works .

Many of them believing that the odds are stacked against them.

From Financial Nihilism by Travis Kling

“Demetri Kofinas, the host of the Hidden Forces podcast coined the term “financial nihilism” – the idea that cost of living is strangling most Americans; that upward mobility opportunity is out of reach for increasingly more people; that the American Dream is mostly a thing of the past; and that median home prices divided by median income is at a completely untenable level.

Financial Nihilism goes hand in hand with Populism – a political approach that strives to appeal to ordinary people who feel that their concerns are disregarded by established elite groups.”

Here is a chart that shows how difficult it is to buy a home:

Source: longtermtrends.net. As of October 2023.

“You can see Boomers (and GenX) bought all the houses at about 4.5x annual income. Then subprime lending fueled the housing bubble and the bubble collapsed. Not long thereafter, Millennials entered the workforce and got to the point where they could start buying houses at ~5.5x annual income. Then Covid happened, the Fed printed $6 trillion, and now houses are 7.5x annual income, much higher than even the peak of the housing bubble. Simply out of reach for many millions of Americans under 40. The numbers just don’t add up.”

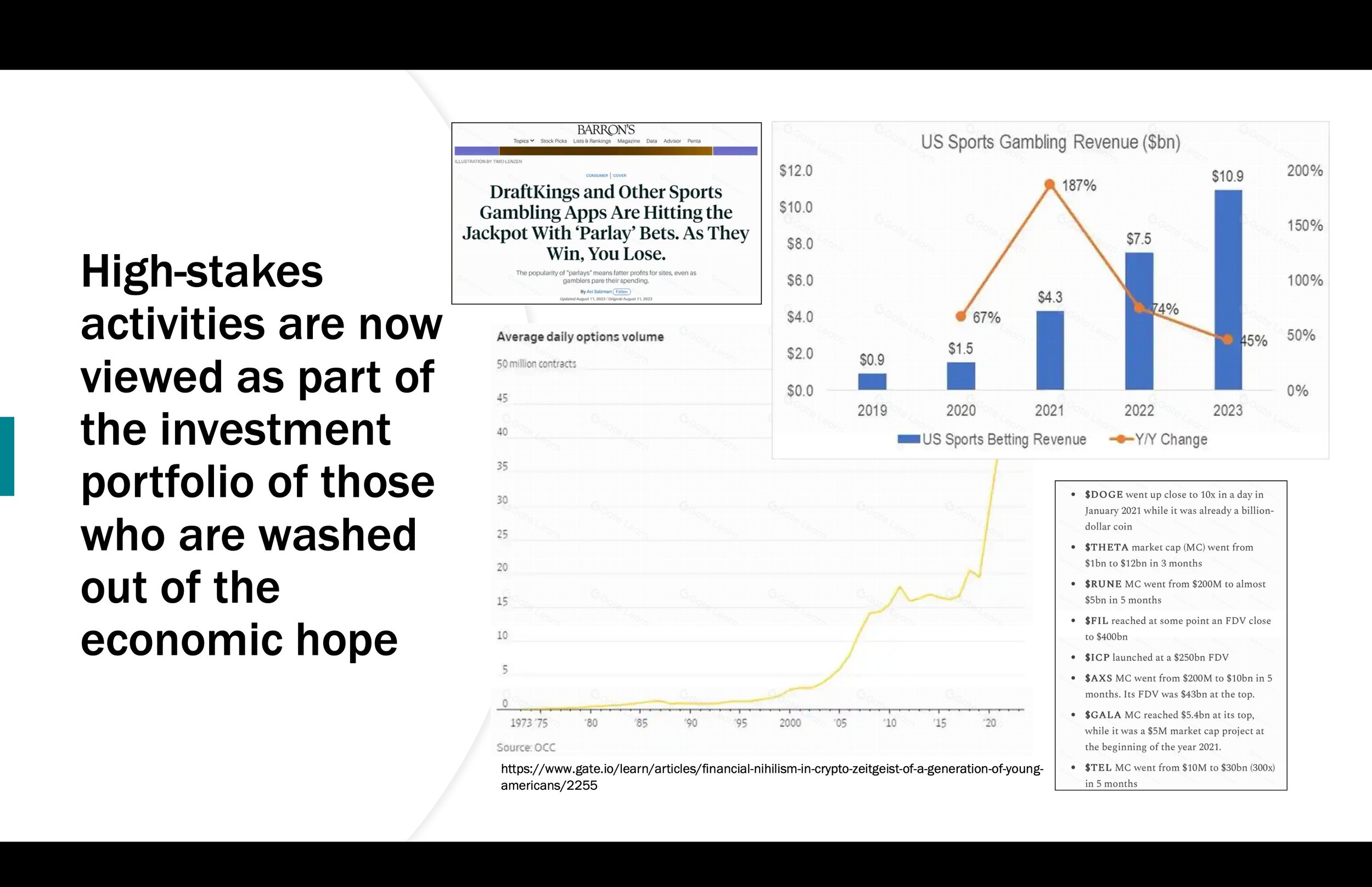

4. Squeezing returns in a faster time frame through massive risk.

While the equity markets have done well over time they are very expensive when compared to median income.

Below is the ratio of Median Household Income to the S&P 500. It calculates how many shares of the SPX index fund can one buy with a year’s worth of median income.

Source: FRED. As of Q3-23.

Back in the early 60’s you could get 94 shares of the SPX with the median household income. That peaked in the crash of 1982 at 219 shares and then structurally collapsed. The stock market is getting less and less affordable for the average American.

So what does one do?

Gamble and find ways to get massive returns in short time since the other options appear to be too slow, too expensive or too closed.

On sports. On meme stocks. On One Day Expiry Options.

Or how about meme coins like catwifhat

People who bought 1 million catwifhat meme coins on Feb 24 would pay a little less than 17 cents which if they had sold a week later on March 1 would have got $5.69 or a 33X (3300) percent return.

3300 percent in a week is mind blowing but is it really?

Lets look at recent price action on some of these coins below.

Yes, Mfer coin has gone up 1 million percent in the past 24 hours, 19.16 percent in the past hour and up 5.46 percent in the past five minutes. But if you had bought Fat Cat 6 hours ago you would be down 47.76 percent but if you had bought it five minutes ago you would be up 10.35 percent.

Hard to get excited about 10 percent return in a quarter for S&P 500 right?

Even though this stuff below will wipe most people out!

5. Short squeezing time?

This meme stuff is irrational one might say.

So lets look at the financials of a stock that is valued at 9 billion dollars and began trading this week.

Yes, you are reading this chart correctly. DJT stock is valued at 9 billion dollars and has revenue of 3.6 million dollars in nine months with a loss of 50 million.

It is selling for 2512 times its revenue compared to Meta at 9.3 times revenue and Reddit which at 11.7 times revenue.

One has an urge to short it.

But one could end up with nothing but ones shorts since shorting this will be taking on a movement and not a financial instrument.

We are not just living in “interesting times”.

We are squeezing time…